Cybersecurity – it’s not just for Bill Gates and computer geeks anymore. Many attorneys now have ethical and legal duties to be compliant with cybersecurity laws and also protect sensitive client information.

Cybersecurity – it’s not just for Bill Gates and computer geeks anymore. Many attorneys now have ethical and legal duties to be compliant with cybersecurity laws and also protect sensitive client information.

While many CLE companies produce and tailor courses for the big law firms of the Am Law 200, our goal is to provide CLE to small firm and solo attorneys. Our courses are delivered by attorneys like you that run their own practice or work in small firms.

There are many requirements to keep track of for your New York CLE requirements. Check out our NY CLE FAQ to make sure you’re in compliance!

Experienced attorneys are those attorneys that have been admitted to the New York State Bar Association for more than two years. Experienced New York attorneys are required to complete at least 24 NY CLE credit hours each 2 year reporting cycle.[1] NY CLE Reporting & Compliance Reporting Cycle: 2 years Compliance Deadline: Birth date Reporting Deadline: 30 days after your birthday Towards…

Retirement savings represent the bulk of many clients’ assets. Therefore, dividing retirement accounts is one of the most important aspects of divorce settlements. With a little practical guidance you can confidently navigate dividing retirement benefits for your clients.

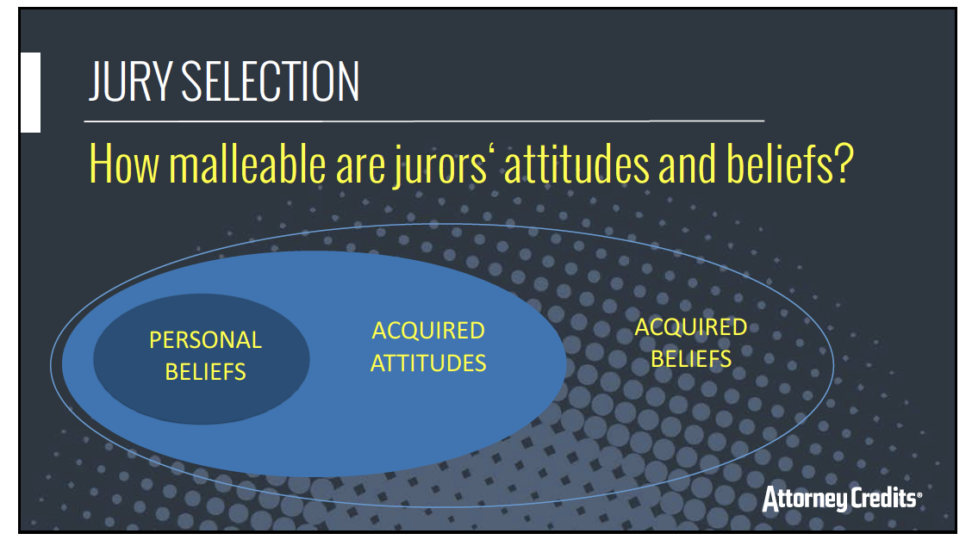

In this CLE course, Dr. David Cannon will mainly address the challenges of selecting a jury in a Facebook world, the key social media platforms to search and how to rate your potential jurors.

Attorneys that have been admitted to the New York Bar for more than 2 years are considered to be experienced attorneys. Experienced attorneys in New York must complete a total of 24 NY CLE credit hours during each biennial reporting cycle.

The goal of this CLE program is to lay out some of the different people groups that you represent and leave you with a better understanding of Arabic-speaking clients. This course qualifies for Professionalism and Bias credits in numerous states.

Experienced attorneys that are licensed to practice in New York may complete all 24 hours through online and downloadable NY CLE courses — in addition to courses on Compact Disc (CD).

Recognizing conflicts at the outset of the representation is key to avoiding ethical headaches and disqualification. Properly deploying conflict software, conflict waivers and engagement letters can prevent many potential problems.