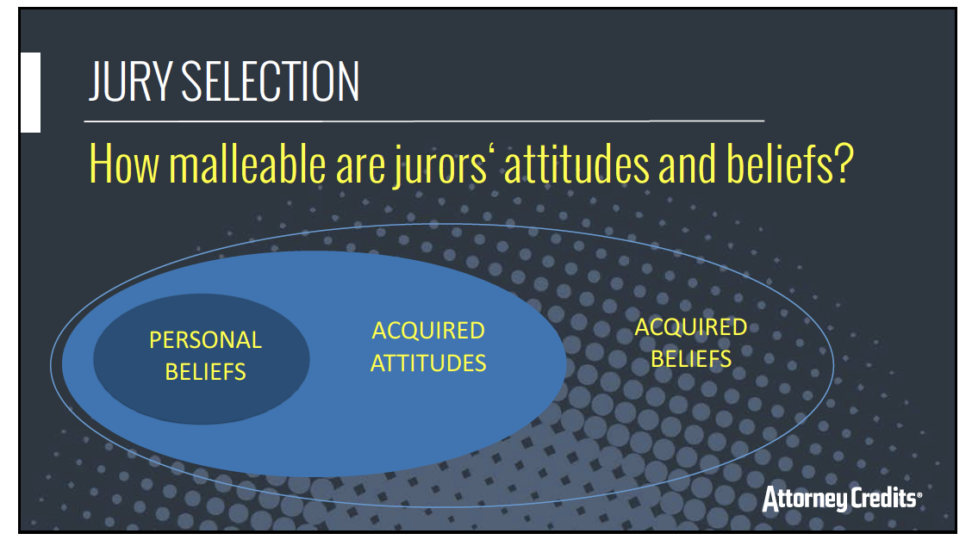

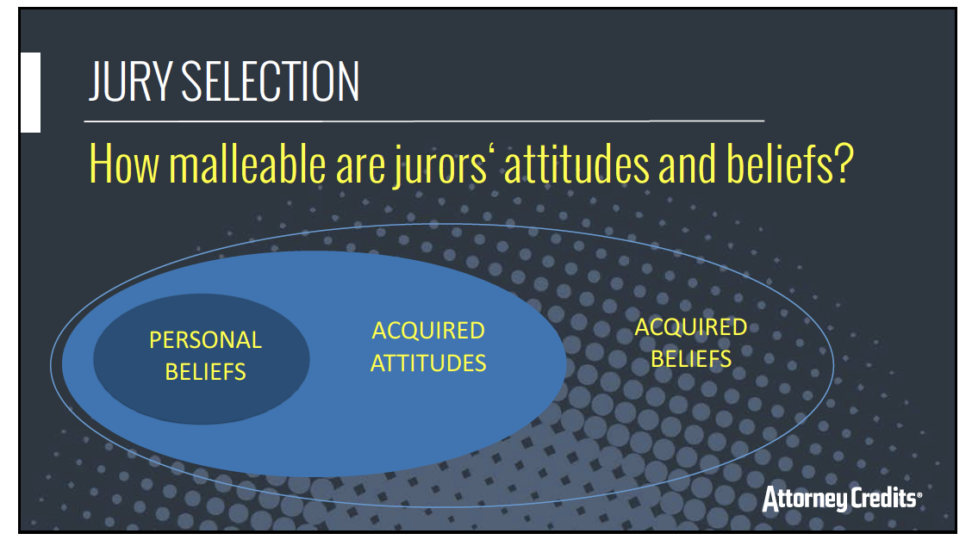

In this CLE course, Dr. David Cannon will mainly address the challenges of selecting a jury in a Facebook world, the key social media platforms to search and how to rate your potential jurors.

In this CLE course, Dr. David Cannon will mainly address the challenges of selecting a jury in a Facebook world, the key social media platforms to search and how to rate your potential jurors.

If your last name starts with A-G and you haven’t completed your CA CLE you still have time. If you comply with your CA MCLE requirement by June 30, then you will only have to pay a $75 late fee and you can avoid being suspended.

The goal of this CLE program is to lay out some of the different people groups that you represent and leave you with a better understanding of Arabic-speaking clients. This course qualifies for Professionalism and Bias credits in numerous states.

Recognizing conflicts at the outset of the representation is key to avoiding ethical headaches and disqualification. Properly deploying conflict software, conflict waivers and engagement letters can prevent many potential problems.

What effect, if any, will the popular CBS TV drama “Bull” have on your jurors? Unfortunately, many trial attorneys do not have several million dollars to hire anything like Dr. Bull’s company. We are on our own to determine the best narrative and jurors.

With the cost of litigation and the current backlog in the courts, mediation has become the main path for redress for many aggrieved parties. In this CLE course mediator Monty McIntyre will teach you the fine points of mediation so you can get the best result for your clients.

Cultural Resources are tangible remains of past human activity that provide unique information about past societies and environments. If you are interested in learning more, Michele Fahley details how statutes like NEPA and the National Historic Preservation Act (NHPA) are deployed to protect these important pieces of our history.

The goal of bankruptcy is the discharge – when the debtor is released from personal liability for certain specified types of debts. Unfortunately, your client may commit certain actions that can prevent them from discharging their debt due to Bankruptcy Code Section 727(a).

Federal Rule of Bankruptcy Procedure 9011 provides that all documents within its scope require the lawyer’s certification of proper purpose, warranted by law or a non-frivolous argument for extension or reversal of the law, and evidentiary factual support.

Whether your primary practice is criminal defense or employment law, you can provide additional value for your clients if you can spot and help address potential immigration issues.