Legal Framework for Crypto & MTLs

This CLE course offers legal professionals an in-depth examination of the complex and rapidly evolving regulatory landscape surrounding money transmitter licensing (MTL) and cryptocurrency businesses. Through detailed case studies and statutory analysis, attorneys will gain practical insights into the legal obligations imposed on financial services providers operating in traditional and digital asset spaces.

Legal Issues for Money Transmission Businesses

The most significant legal issues for money transmission businesses involve navigating a complex regulatory landscape that includes strict federal and state licensing requirements, robust anti-money laundering (AML) protocols, and extensive reporting and record-keeping obligations. Failure to comply can result in severe civil and criminal penalties.

Cryptocurrency and Money Transmission Licenses: Legal Issues

The course begins by defining a “money transmitter” and outlining the foundational legal principles that apply to money services businesses (MSBs). It then explores the regulatory requirements imposed by the FinCEN and state regulators, using real-world enforcement actions — such as those involving Coinstar, Ripple Labs, Sigue Corporation, and Block Inc. — to highlight the legal and financial risks of non-compliance. The training also examines the specific compliance burdens facing cryptocurrency companies, including licensing requirements like BitLicenses, ongoing AML/BSA obligations, and emerging legislation like California’s Digital Financial Assets Law (DFAL). Finally, the course concludes with a look at how artificial intelligence (AI) is streamlining the licensing process and regulatory compliance. To access the course please click here: Legal Framework for Cryptocurrency and Money Transmission Licenses.

Learning Objectives:

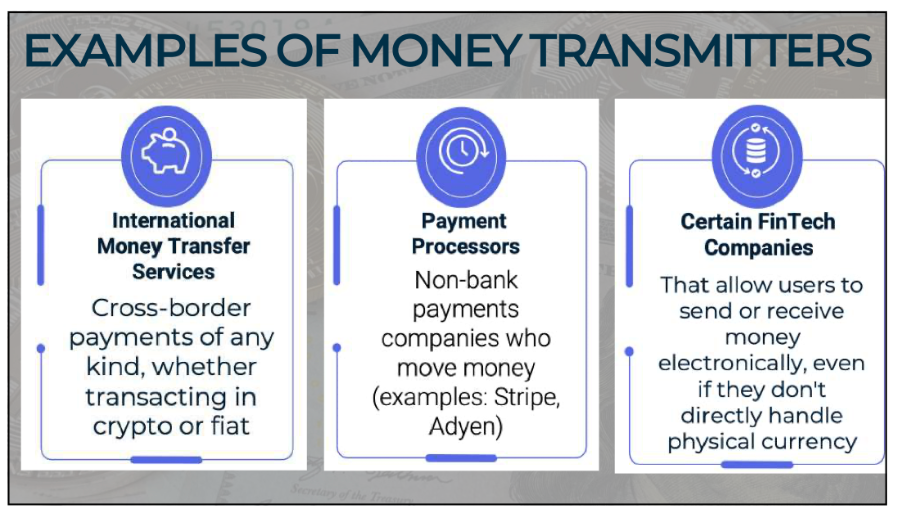

• Define what constitutes a money transmitter under federal and state law

• Identify state-specific licensing requirements for cryptocurrency companies

• Analyze key enforcement actions and understand their implications for compliance

• Understand licensing prerequisites, including financial, operational & documentation standards

• Apply knowledge of ongoing maintenance requirements for MTLs and crypto licenses

• Evaluate how AI and technology are transforming licensing and compliance workflows

Molly Siems Cavanaugh, Esq. & Snigdha Kumar, C.E.O – Brico

Molly Siems Cavanaugh, Esq., has a diverse background in business development, channel sales, and strategic planning that has honed her ability to identify market opportunities, develop innovative strategies and execute with precision. The CEO of Brico, Snigdha Kumar has over 10 years of experience working in FinTech in operations, strategy, partnerships and consulting roles, including investing, banking, cash advance, savings and payments. To book a demo click here: DEMO.

This CLE course is offered in the following states:

* Alaska (AK)

* Alabama (AL)

* Arizona (AZ)

* California (CA)

* Connecticut (CT)

* District of Columbia (DC)

* Georgia (GA)

* Illinois (IL)

* Maryland (MD)

* Massachusetts (MA)

* Michigan (MI)

* Missouri (MO)

* Nevada (NV)

* New Hampshire (NH)

* New Jersey (NJ)

* New York (NY)

* North Dakota (ND)

* Ohio (OH)

* Oregon (OR)

* Pennsylvania (PA)

* South Dakota (SD)

* Tennessee (TN)

* Vermont (VT)

* Washington (WA)

California CLE

Attorney Credits offers CLE for attorneys in California and around the country. For more information about CLE in California please click the following link: CA CLE.