Nicole highlights the common pitfalls that cause employers to end up in lawsuits over hiring and she provides highly practical information to help your clients avoid these common issues.

Nicole highlights the common pitfalls that cause employers to end up in lawsuits over hiring and she provides highly practical information to help your clients avoid these common issues.

How many questions do you ask before you make important decisions? Do you assume you know what is best for this case and for this client – simply based on all your previous cases? Implicit Bias Are there subconscious forces that impact how you think and how you feel? And how do these hidden forces impact your decision making? This CLE course…

If you comply with the California MCLE requirement by June 30, you do not need to request an extension of time. You will be assessed a late fee of $75.

To learn about the steps firms and legal organizations can take to create a more level playing field, join Andi Kramer and Al Harris for a thoughtful discussion about overcoming gender bias to create a more successful and profitable law firm.

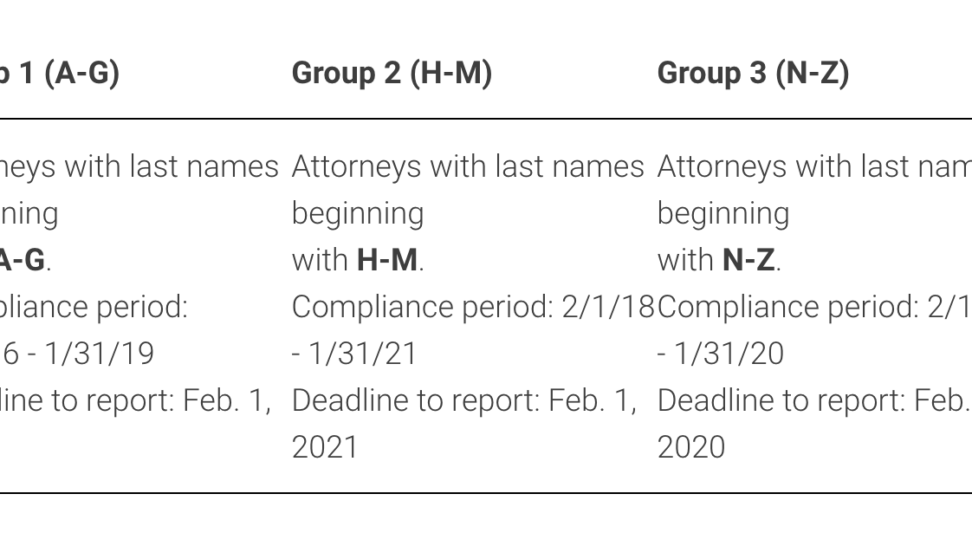

California attorneys must complete 25 hours, including 4 legal ethics, 1 competence issues and 1 elimination of bias every 3 years. Attorneys A-G must complete and report the California MCLE requirement by February 1, 2019.

California attorneys must complete 25 hours every 3 years.

A passionate advocate for her clients, Ashley Arcidiacono provides key points when analyzing defensive asylum cases and shares strategies and trial tips so you can get the best results for clients trying to prevent removal from the United States.

Completing your 25 hours of California MCLE… don’t forget to complete at least 4 hours of Legal Ethics, 1 hour of Competence Issues and 1 hour of Elimination of Bias.

California attorneys with last names A-G must complete and report 25 CA MCLE hours by February 1, 2019.

Many states have December 31 CLE deadlines. If you live in a state with a December 31 CLE deadline, it’s time to get started. We have the online CLE that you need!